Homestead Exemption in Texas: What is it and how to claim

What is a homestead in Texas?

A homestead can be your single family home, townhouse, condominium, mobile home, manufactured house or any other independent structure which is your primary residence. An urban homestead can include upto 10 acres of owned or leased land in which the residence is located. The homeowner must be an individual or a trust, not a corporation or other business entity.

What is a homestead exemption in Texas?

The Homestead Exemption is a rebate on the appraised value of the homestead, as on January 1st of the given year. It is not a tax credit. If an individual owns several properties, homestead exemption is available only on the primary residence of the owner. If you have multiple homes in different counties, you can claim exemption only on one of them.

Remember that your county’s appraisal district is tasked with appraising your property’s value. They don’t set the taxes. The taxes are set by the individual taxing units in the county viz. school district, community college, flood control, port, sewer, utilities etc. Each of these may separately offer an exemption on residence homestead.

How much is the homestead exemption in Texas?

A property owner may avail one or more of the following exemptions in Texas:

- School district: All property owners are allowed an exemption of $100,000 on their residence homestead. If a home is appraised at $350,000, then a residence homestead exemption will bring down the appraised value to $250,000 for the school district. The net effect of the exemption is to reduce your property tax. Considering a 1% tax rate set by the school district, a home assessed at $350,000 will have to pay $3,500 in actual property tax. With the exemption, the tax amount will reduce to $2,500, netting the owner $1,000 in actual savings. Latest on the topic: On 13th February 2025, Texas Senate unanimously passed SB 4, which proposes to raise the general homestead exemption to $140,000. If the House passes it, then your homestead exemption increase will be effective for 2025 year itself. Here’s our detailed take on the topic.

- County government: If the county government collects a special tax for roads or flood control, then a residence homestead can avail a $3,000 exemption on the appraised value. Considering the example above, a county government will value the property at $347,000 ($350,000 - $3,000).

- Senior citizen and/or disabled homeowners: Individuals aged 65 or older and disabled persons get an additional $10,000 school district exemption. For a senior citizen or a disabled homeowner, the school district will provide a $50,000 exemption on their assessed value. In case a person is over 65 years of age and is also disabled, they can claim exemption on only one of the criteria i.e., either over 65 or disabled, but not both. On 2nd November 2021, Texas voters approved a constitutional amendment (Prop 7) to allow the surviving spouse of a disabled individual to maintain a homestead property tax limit if the spouse is 55 years of age or older at the time of the death and remains at the homestead.

- Veteran’s exemption: Texas offers partial to total exemption from property taxes to disabled veterans on their homesteads. We have covered veteran’s exemption in detail here. Texas voters approved Prop 8 allowing a total residence homestead property tax exemption for a surviving spouse of a member of the armed services “who is killed or fatally injured in the line of duty.”

- Other taxing unit exemptions: Texas law permits any taxing unit in a county to offer additional exemptions of up to 20% of the assessed value. If they do offer an exemption, then the minimum exemption they have to offer is $5,000. Such taxing units may additionally offer a $3,000 exemption for senior citizens or disabled persons.

How do I apply for a homestead exemption in Texas?

When you move in to a new home, you may apply for your homestead exemption along with supporting documents, to the appraisal district where your home is located. Applying for homestead exemption is FREE. DO NOT PAY anyone for this. You can do it yourself. It takes barely a few minutes.

I just moved in to my new home. When should I apply for homestead exemption?

Effective January 1st 2022, new homeowners in Texas can apply for homestead exemption in the first year of their homeownership itself, instead of having to wait for a year. Ref: Senate Bill 8

Can I file Texas homestead exemption application online?

Yes, many appraisal districts have an online homestead application. In fact, CADs encourage homeowners to apply for homestead exemption online for quicker filing and expedited processing. Here is why you should apply for homestead exemption online:

- Application is pre-filled with your information available in the CAD records.

- No need to print, mail or submit in person. Saves you time and effort.

- When you apply online, you get an immediate confirmation on your email.

- Online applications also save manual entry effort for the CAD staff.

- Your application status is updated sooner on the website.

Before you start your online application, keep a photo or a scanned copy of your Texas Driver’s License ready.

Applying for homestead exemption is FREE. DO NOT PAY anyone for this. You can do it yourself. It takes barely a few minutes. Here are some of the counties that provide an online homestead exemption form. If you don’t find your county listed here, check with your county’s appraisal office if they accept online forms for this exemption.

- Harris county homestead exemption form

- Travis county homestead exemption

- Tarrant county online homestead exemption form

- Fort Bend county online homestead exemption form

- Hidalgo county online homestead exemption form

- Williamson county online homestead exemption form

How to fill out a homestead exemption form?

Homestead property tax exemption is to be claimed on Form 50-114. Instructions for filling out the form are provided in the form itself. Our guide How to fill a Texas Homestead Exemption form may also help. The pdf form provided at the Texas comptroller’s website is an editable pdf, meaning, you can download the form onto your laptop, desktop or mobile. Open it with your favorite pdf viewer and type in the details. Once you are done filling up all information, print it, sign it, date it and submit along with the supporting documents to your county appraisal district.

Many counties also let you submit the form online. Check your county appraisal district’s website or check the previous section in this article for links.

Texas Homestead exemption Application Deadline

Completed homestead exemption application form along with supporting documents have to be filed between January 1st and April 30th, for the year in which you begin to claim this exemption.

Say you moved from Houston to Austin in September. Then you will have to claim homestead exemption for that year in Harris county. You can avail homestead exemption in Travis county, the following year onwards. The thumb rule to determine your county for the sake of homestead exemption is to ask this question: “Which county was your primary residence on January 1st?” Be aware that a homeowner can claim exemption in only one county for a given year. Property owners must notify the chief appraiser in writing before May 1 of the year after their right to this exemption ends.

The due date for persons aged 65 or older; disabled; or partially disabled veterans with donated homesteads to apply for the exemption is no later than the first anniversary of the qualification date. A late application for a residence homestead exemption may be filed up to two years after the deadline for filing has passed. (Tax Code Section 11.431). A late application for residence homestead exemption filed for a disabled veteran (not a surviving spouse) under Tax Code sections 11.131 or 11.132 may be filed up to 5 years after the delinquency date.

Surviving spouse of a disabled veteran, who files under Tax Code sections 11.131 or 11.132, may file up to two years after the delinquency date, for a late application for residence homestead exemption.

If the chief appraiser grants the exemption(s), the property owner does not need to reapply annually, but must reapply if the chief appraiser requires it. Property owners already receiving a general residence homestead exemption who turn age 65 in that next year are not required to apply for age 65 or older exemption if accurate birthdate information is included in the appraisal district records or in the information the Texas Department of Public Safety provided to the appraisal district under Transportation Code Section 521.049.

Supporting documents for homestead exemption

Attach a copy of the property owner’s driver’s license or state-issued personal identification certificate. The address listed on the driver’s license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested.

The chief appraiser may waive the requirements for certain active duty U.S. armed services members or their spouses or holders of certain driver’s licenses.

Heir Property

Heir property is property owned by one or more individuals, where at least one owner claims the property as a residence homestead, and the property was acquired by will, transfer on death deed, or intestacy. An heir property owner not specifically identified as the residence homestead owner on a deed or other recorded instrument in the county where the property is located must provide:

An affidavit establishing ownership of interest in the property on Form 50- 114-A

- A copy of the prior property owner’s death certificate

- A copy of the property’s most recent utility bill

- A citation of any court record relating to the applicant’s ownership of the property, if available. Each heir property owner who occupies the property as a principal residence, other than the applicant, must provide an affidavit that authorizes the submission of the application

If you inherit a property, you need to reapply for your homestead exemption

Manufactured Homes

Manufactured homeowners must provide:

- A copy of the Texas Department of Housing and Community Affairs statement of ownership showing that the applicant is the owner of the manufactured home

- A copy of the sales purchase agreement, other applicable contract or agreement or payment receipt showing that the applicant is the purchaser of the manufactured home; or

- An affidavit on Form 50-114-A by the applicant indicating

that:

- The applicant is the owner of the manufactured home;

- The seller of the manufactured home did not provide the applicant with the applicable contract or agreement; and

- The applicant could not locate the seller after making a good faith effort

The chief appraiser may request additional information to evaluate a homestead application. Property owners must comply within 30 days of the request or the application will be denied. The chief appraiser may extend this deadline for a single period not to exceed 15 days for good cause shown.

Homestead Exemption for Partial Ownership - Unmarried Co-owners

If you have partial ownership but are not married or did not inherit property, the exemption amount is based on the interest you own. For example, if you own a 50 percent interest in a homestead, you will receive only one-half, or $50,000 of the $100,000 general homestead exemption offered by your school district. Property owners not identified on a deed or other instrument recorded in the applicable real property records as an owner of the residence homestead must provide an affidavit or other compelling evidence establishing the applicant’s ownership interest in the homestead. In section 2 of Form 50-114, fill up your and your partner’s info and ownership percentages. Be aware that there can be only one Homestead exemption application for joint ownership of property. Ownership percentages have to be listed on the same HS exemption form while applying. Ref. Section 11.13(h) of the Texas Property Tax code.

(h) Joint, community, or successive owners may not each receive the same exemption provided by or pursuant to this section for the same residence homestead in the same year.

Homestead Exemption for Married Couples

If a property is jointly owned by a married couple and both reside there, then the spouses are treated as community property owners with 100 percent ownership for each spouse. Doesn’t mean that both the husband and wife can apply separately to claim the exemption twice! Both can apply only once and the exemption is granted together.

Surviving Spouse of a First Responder Killed in the Line of Duty

The surviving spouse of a first responder who is killed or fatally injured in the line of duty is entitled to an exemption from taxation of the total appraised value of the surviving spouse’s residence homestead if the surviving spouse:

is an eligible survivor for purposes of Chapter 615 (Financial Assistance to Survivors of Certain Law Enforcement Officers, Firefighters, and Others) , Government Code, as determined by the Employees Retirement System of Texas under that chapter; and has not remarried since the death of the first responder.

What is the last day to file homestead exemption in Texas?

Homestead exemption applications on Form 50-114 must be received no later than April 30th of the year in which you like to claim the exemption.

What if you forgot to file homestead exemption form in time?

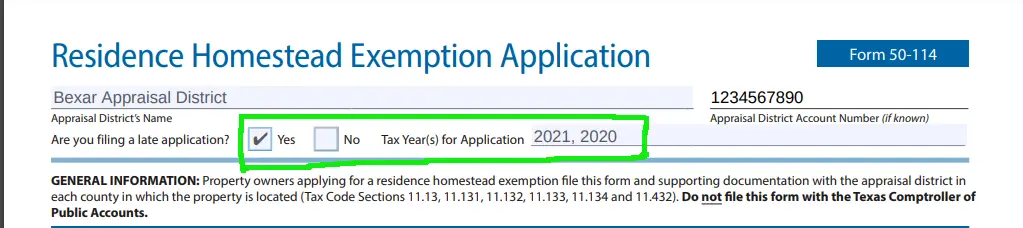

In case you missed filing on time, you can file for a homestead exemption retroactively for upto two years. When filling out Form 50-114, check the ‘Yes’ box for ‘Are you filing a late application’ and indicate the tax year(s) for which you like to retroactively claim exemption. In case you have already paid property taxes for the past year(s), you will get a refund. If not paid, then you will get a new tax bill with a lower amount. If you file your homestead exemption before April 30th, you will be in time for the exemption to take effect when the current year’s property tax bills are mailed in fall. Else, it will be applied retroactively.

How much does the homestead exemption save?

Remember that homestead exemption lowers your home’s appraised value. The actual tax savings you realize will depend on the tax rate your county’s taxing units adopt for the given tax year.

Homestead exemption gives you $100,000 off on your appraised value for school district taxes. Seniors and disabled homeowners get an additional $10,000 off. Your county government may offer $3,000 off on the appraised value. Other taxing units may offer upto 20% off with a minimum of $5,000. They may also offer seniors and disabled persons an additional $3,000 off on the appraised value.

Say your home was valued at $250,000 and your county’s school district adopts a tax rate of 1%. Then the school district’s share of the property tax for the year is $2,500. Once you apply for homestead exemption, the county’s school district will assess your home at $110,000 and tax amount will be $1,100. Thus, you save $1,400.

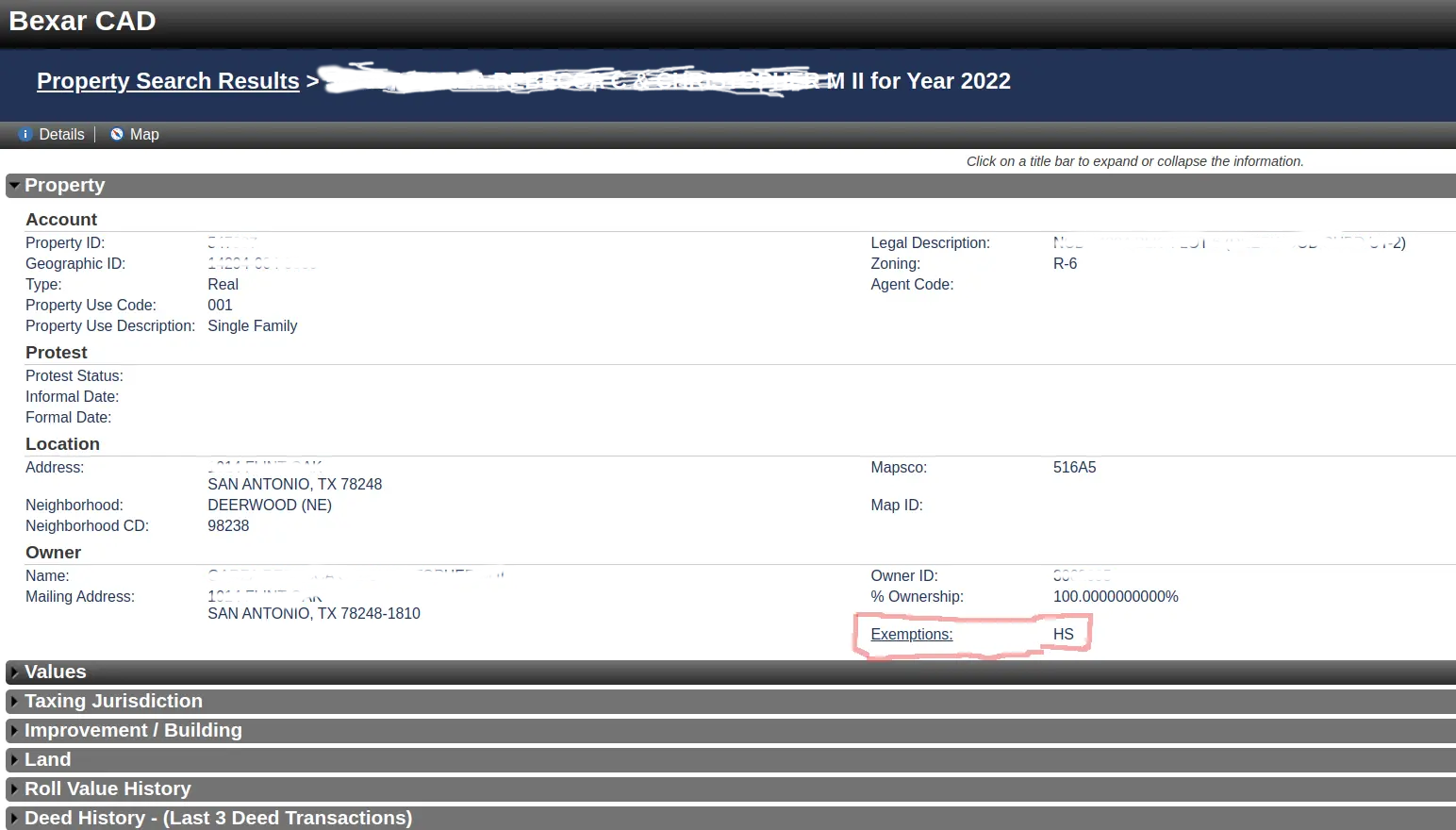

How to check homestead exemption status in Texas?

You can check your homestead exemption status on the appraisal district’s website. Search for your property and open your property details page. You should see your homestead exemption status on the property details page. Here are examples of homestead exemption status from Harris CAD and Bexar county appraisal district property search pages:

What is homestead cap?

Properties are appraised at their fair market value. In a booming housing market, home prices could shoot up by 15% or more annually. That will result in a proportionate rise in property taxes, since property taxes are ad-valorem. However, this may cause hardships to homeowners. In order to prevent such sudden spikes in property taxes, in 1997, Texas voters voted to limit increases in appraised values for homestead properties. Texas homestead cap limits annual property assessments to be the least of:

- the fair market value; OR

- 10% over the preceding year’s appraised value + value of any improvements made since the last appraisal

Note that homestead cap is applicable only to the primary residence. If you have rental or investment properties, they will likely get assessed at their fair market value.

How much land can you homestead in Texas?

As per Texas Property Code Section 41, an urban home can include upto 10 (ten) acres of land in one or more contiguous lots, along with any improvements. A rural homestead can include upto 200 acres in one or more parcels, for a family or upto 100 acres for a single adult.

Can a married couple have two homesteads in Texas?

No, a married couple can only claim one homestead and avail exemption as well as homestead protection on it. However, if they are living separately then they can claim homesteads separately on their respective homes.

Can I claim homestead exemption on rental property in Texas?

Nope. Homestead exemption is available only to homeowners who reside in that house. If you own multiple properties, you can claim homestead exemption only on your principal residence. Rental, vacation or investment properties are not eligible for homestead exemption. If you need to move away from your homestead temporarily, you can still retain homestead exemption for upto two years, so long as you don’t establish a permanent residence elsewhere. In case you need to move out of your house for military service, then you can continue to enjoy homestead exemption, until you return.

Does homestead exemption expire in Texas?

Once your homestead exemption is approved, it remains valid for five years. After which you have to reapply. Homestead exemption also gets revoked if:

- you sell the house or add/remove owners or change your name or make any kind of changes to the deed.

- you move to a new house and claim homestead on that house.

- the Chief Appraiser asks you to re-apply.

These are the cases where you lose your homestead exemption.

What is prorated homestead exemption in Texas?

Homeowners who purchased their homes after January 1st 2022 can claim a prorated general homestead exemption for the remainder of the year. This was made possible by Senate Bill 8. To claim a prorated exemption:

- the homeowner must be residing in that new home. i.e., it should be their primary residence.

- the property should have been purchased on or after January 1st 2022.

- the property cannot already have a general residence homestead for the rest of the year. i.e, if the previous owner had claimed HS exemption on it for the year, then the new owner will not be able to claim a pro-rated HS exemption for that year.

- the property owner cannot already be claiming homestead exemption on another property for that year.

Note that you still have to wait a year for your homestead cap to take effect.

When will my homestead cap kick in?

Your homestead cap kicks in from the second Jan 1st after you occupy your house. e.g., say you moved in on March 3rd 2023. The appraised value of your house as on Jan 1st 2024 forms your “base year” value. The capped value kicks in from Jan 1st 2025 onwards. So the capped value of your house on Jan 1st 2025 will be your base year value + 10%.

When will my homestead exemption kick in?

Generally, your homestead exemption begins the first Jan 1st after you occupy your house. However, in some cases you can claim a prorated homestead exemption for the remainder of the year in which you begin occupying your house.

If I had a homestead exemption and I move to a new home, can my homestead exemption be transferred?

Nope, you cannot transfer your homestead exemption. You have to apply for removal of homestead exemption on your old home and apply for homestead exemption for the new home afresh. If you are the surviving spouse of a 100% or totally disabled veteran, surviving spouse of a member of the US Armed Forces killed in action or the surviving spouse of a first responder killed in the line of duty, then you can transfer the property tax exemption and ceiling to your new homestead by applying on Form 50-808. Seniors also can transfer their school district tax ceiling to their new homestead. Before moving, you will have to request a transfer certificate from the Chief Appraiser in the appraisal district where your old home is located. And present that to the new appraisal district.

If you are over 65 and had the school district taxes frozen, then you can transfer the exact percentage of the school district tax ceiling. e.g., when you turned 65, say, your old house was valued at $240,000. Your senior exemption will bring down the value to $100,000. Your ISD portion of the tax was $1,000, assuming a 1% ISD tax rate. After a few years, let’s assume the value of your old house increased to $340,000. But the tax ceiling lets you continue paying $1,000 in ISD taxes. So, your effective ISD tax rate is 0.5%. When you move to your new home, you would then pay 0.5% in school district taxes for your new home.

Do I have to file homestead exemption every year in Texas?

Nope, not every year, but once in five years. Until 2023, there was no need to reapply at all once you occupied and lived there. However, due to the numerous abuses of this provision, Texas Legislature passed a law in April 2023 that requires the Chief Appraiser to re-verify homestead exemptions every five years. Once your homestead exemption is approved, it remains valid until:

- You sell the house or add/remove owners or make any kind of changes to the deed.

- You move to a new house and claim homestead on that house.

- The Chief Appraiser asks you to re-apply.

Is it too late to file for homestead exemption in Texas?

Beginning January 1st 2022, new homeowners can apply for homestead exemption any time of the year. You can also file a late homestead exemption for upto two years after you move in to your primary residence. You can also file for a homestead exemption retroactively for upto two years. When filling out Form 50-114, check the ‘Yes’ box for ‘Are you filing a late application’ and indicate the tax year(s) for which you like to retroactively claim exemption. Several new homeowners are unaware of homestead exemption and find out about it after several years. By that time they would have paid an unfair amount of property taxes.

How long does it take for homestead exemption to take effect in Texas?

Typically, most appraisal districts process homestead exemption applications in 4 to 6 weeks. But during the protest hearings season (March through July), your county appraisal district may take more time to process the application. If you applied during the protest season, your homestead applications take several months to be processed. Hence, our recommendation is that you apply for your homestead exemption as soon as you move in and have your Texas DL address updated. Beginning 2022, new homeowners can apply for homestead exemption anytime of the year. You may even be eligible for a prorated exemption, in certain cases.

When will my homestead exemption kick in?

Depends on whether the previous owner had a homestead exemption. If the previous owner didn’t have one, then you can claim a prorated homestead exemption for the current year itself. In that case, your homestead exemption kicks in the current year itself. Else your homestead exemption begins the next Jan 1st. If the previous owner had a homestead exemption, then your homestead exemption kicks in the next year.

Your homestead cap kicks in from the second Jan 1st after you occupy your house. e.g., say you moved in on March 3rd 2023. The appraised value of your house as on Jan 1st 2024 forms your “base year” value. The capped value kicks in from Jan 1st 2025 onwards. So the capped value of your house on Jan 1st 2025 will be your base year value + 10%.

How long does homestead exemption last?

Once approved, homestead exemption lasts five years. Your appraisal district will send you a notice to renew after five years. Those who already have an approved homestead exemption also need to renew. But, not everyone needs to rush and re-apply. Look out for a notice from your appraisal district asking you to re-apply. They also send a post-card every December/January confirming the exemptions you have. You can also check online on the appraisal district website and confirm your exemptions are in place. If not, file your application online. In case your exemption is gone, no need to panic. Re-apply and call the appraisal district, explain you have been living there since ‘x’ years and that you had the homestead exemption before. They may ask you to submit copies of your utility bills to establish you were residing there.

Homestead exemption application used to be a one-time thing until 2023. Due to homestead exemption abuses (like people claiming exemption on multiple homes, rental / AirBnB properties etc.), Texas legislature passed a bill in Spring 2023 requiring the Chief Appraiser in each county to re-confirm homestead exemptions every five years. Most appraisal districts have come up with a staggered renewal plan. A section of the homes (by subdivision, zipcode, owner last names etc) are notified each year to renew their exemptions. So that they can cover the entire county in five years and they don’t get overwhelmed with renewal requests at once. e.g., Tarrant Appraisal district has published their staggered renewal plan based on map-numbers. Kendall appraisal district’s plan is to renew based on the owner’s last name.

How much is the homestead exemption in Houston?

Apart from the $100,000 general homestead exemption, several taxing units in Houston area offer homestead exemptions upto 20%

How does name change after marriage affect homestead exemption?

Say you bought a house with your partner. You both signed the sale deed jointly. If you get married and change your maiden name, how does it affect your homestead exemption? As per Texas tax laws,

If a married couple qualifies their property for residence homestead exemption, the spouses are treated as community property owners with 100 percent ownership for each spouse.

Hence, only one of you need to qualify fully to get the benefit of homestead exemption. Make sure both your driving licenses are updated to reflect your new address. When applying on Form 50-114, select “Married Couple” and provide ownership details.

How much is the Travis County homestead exemption?

Resident homeowners in Travis County get $100,000 general homestead exemption from their school district. Travis County also provides a 20% homestead exemption. The City of Austin provides a 20% exemption on your net appraised value. Travis County healthcare district provides a 20% exemption. Other taxing units in the county can offer a minimum of $5,000 exemption, upto 20%.

e.g., let’s assume your ISD’s property tax rate is 1.3%. Then you save $1,820 on school district taxes. Similar savings are available from other taxing units.

In addition, if you are over 65 years of age or disabled, you get an extra $10,000 off i.e, your general homestead exemption will be $150,000. Other taxing units may also offer you specific exemptions. You can check your applicable exemptions on Travis County Appraisal District’s property search page. Scroll to the “Exemptions and Jurisdictions” section.

Read more on Travis County Homestead Exemption.

How much is the homestead exemption in Dallas?

Homeowners in Dallas County get $100,000 general homestead exemption from their school district. Dallas County, The City of Dallas, Dallas College and Parkland Hospital, all provide a 20% homestead exemption.

How much is the homestead exemption in Fort Bend?

Fort Bend homeowners County get $100,000 general homestead exemption from their school district. Most cities in the county offer a $5,000 general exemption and an additional exemption for seniors and disabled. Other taxing units in the county can offer a minimum of $5,000 exemption, upto 20%.

Read more on Fort Bend County Homestead Exemption.

Disclaimer

Articles presented here are for general information and education only. It is provided as a courtesy to the general public. SQD Taxtech LLC does not warrant that it is accurate or complete. Opinions expressed and estimates or projections given are those of the authors or persons quoted as of the date of the article with no obligation to update or notify of inaccuracy or change. This article may not be reproduced, distributed or further published by any person without the written consent of SQD Taxtech LLC. Please cite source when quoting.

SQD Taxtech LLC, its managed affiliates and subsidiaries, as a matter of policy, do not give tax, accounting, regulatory or legal advice. Rules in the areas of law, tax, and accounting are subject to change and open to varying interpretations. You should consult with your other advisors on the tax, accounting and legal implications of actions you may take based on any strategies presented, taking into account your own particular circumstances.