March 25, 2023

Fort Bend County Homestead Exemption: All you need to know

How much is the homestead exemption in Fort Bend County?

Fort Bend homeowners County get $100,000 general homestead exemption from their school district. Most cities in the county offer a $5,000 general exemption and an additional exemption for seniors and disabled. Other taxing units in the county can offer a minimum of $5,000 exemption, upto 20%.

If your ISD tax rate is 1.3%, then you save $520 on school district taxes. Similar savings are available from other taxing units.

In addition, if you are over 65 years of age or disabled, you get an extra $10,000 to $25,000 off on your school district appraised value. Other taxing units may also offer specific exemptions for seniors and disabled.

How to apply for homestead exemption in Fort Bend?

Fort Bend county homestead application is available online at https://www.fbcad.org/homestead-exemptions/. They have a video walk through as well.

When is the Fort Bend County homestead exemption deadline?

Fort Bend county homestead exemption applications are due by April 30th each year. Beginning Jan 1st 2022, you can apply for your homestead exemption as soon as you move in and get your Texas DL updated. In case you forgot to apply, you can claim homestead exemption retroactively for upto 2 years

How do I check Fort Bend homestead exemption status?

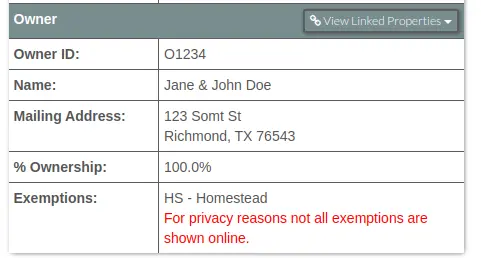

You can check your Fort Bend County Homestead Exemption status on Fort Bend County Appraisal District's property search page. You can search by your address, account or owner name. Once the record shows up, click on it and go to your property details page. Scroll to the "Exemptions" section. Here is an example:

Disclaimer

Articles presented here are for general information and education only. It is provided as a courtesy to the general public. SQD Taxtech LLC does not warrant that it is accurate or complete. Opinions expressed and estimates or projections given are those of the authors or persons quoted as of the date of the article with no obligation to update or notify of inaccuracy or change. This article may not be reproduced, distributed or further published by any person without the written consent of SQD Taxtech LLC. Please cite source when quoting.

SQD Taxtech LLC, its managed affiliates and subsidiaries, as a matter of policy, do not give tax, accounting, regulatory or legal advice. Rules in the areas of law, tax, and accounting are subject to change and open to varying interpretations. You should consult with your other advisors on the tax, accounting and legal implications of actions you may take based on any strategies presented, taking into account your own particular circumstances.