December 01, 2022

Texas Homestead Exemption Form: Is the applicant identified on deed or other recorded instrument?

Sole owner or partial owner

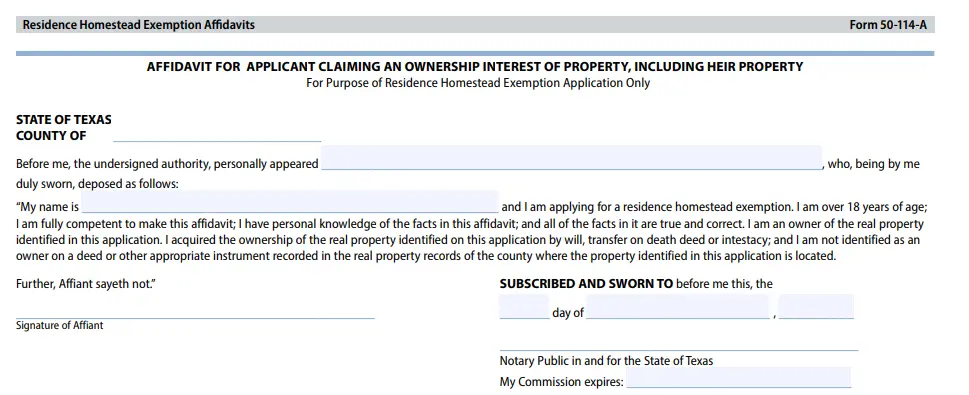

If you are the sole owner or partial owner of the property, your name will be listed on the sale deed. Check "Yes" for this question and provide the deed number. You can find the deed number on your deed papers. You can also look them up on your county clerk's website. If your ownership is not on record, then you need to provide a notarized affidavit on Form 50-114-A affirming your ownership interest in the property.

Heir Property Homestead Exemption in Texas

If you acquired the property by will, "transfer on death" deed or intestacy, and you were not specifically identified on the deed or any recorded instrument in the county, then you need to provide:

- an affidavit establishing ownership of interest in the property on Form 114-A.

- a copy of the prior property owner’s death certificate;

- a copy of the property’s most recent utility bill; and

- A citation of any court record relating to the applicant’s ownership of the property, if available.

Each heir property owner who occupies the property as a principal residence, other than the applicant, must provide an affidavit that authorizes the submission of this application.

Here is a complete guide to filling up your Texas homestead exemption form.

What if you forgot to file your Texas homestead exemption?

Disclaimer

Articles presented here are for general information and education only. It is provided as a courtesy to the general public. SQD Taxtech LLC does not warrant that it is accurate or complete. Opinions expressed and estimates or projections given are those of the authors or persons quoted as of the date of the article with no obligation to update or notify of inaccuracy or change. This article may not be reproduced, distributed or further published by any person without the written consent of SQD Taxtech LLC. Please cite source when quoting.

SQD Taxtech LLC, its managed affiliates and subsidiaries, as a matter of policy, do not give tax, accounting, regulatory or legal advice. Rules in the areas of law, tax, and accounting are subject to change and open to varying interpretations. You should consult with your other advisors on the tax, accounting and legal implications of actions you may take based on any strategies presented, taking into account your own particular circumstances.